Shop

Showing all 7 results

-

Calming Dog Bed

$24.99 Buy product -

Sale!

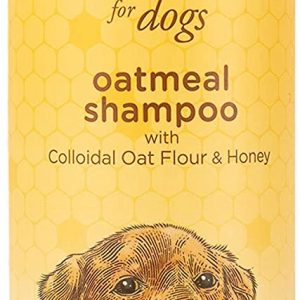

Oatmeal Shampoo for Dogs, Colloidal Oat Flour & Honey

$6.39 Buy product -

Orthopedic Dog Bed for Extra Large Dogs – XL

$61.99 Buy product -

Sale!

Orthopedic dog Sealy Gel Cooling Dog Bed

$105.99 Buy product -

Sale!

Orthopedic Memory Foam Extra Large Dog Bed

$135.89 Buy product -

Plush Dog Toy Pack for Puppy

$20.98 Buy product -

Skinny Peltz No Stuffing Squeaky – ZippyPaws

$9.99 Buy product